retroactive capital gains tax reddit

The proposed capital gains increase will. The plan to make its tax increases retroactive makes no sense if the objective is as the Biden administration claims to raise revenue rather than to punish the successful.

The Capital Gains Rate Historical Perspectives On Retroactive Changes Hub K L Gates

Not only does he want to raise taxes on capital gains to a modern high of 434 he wants to do it retroactively.

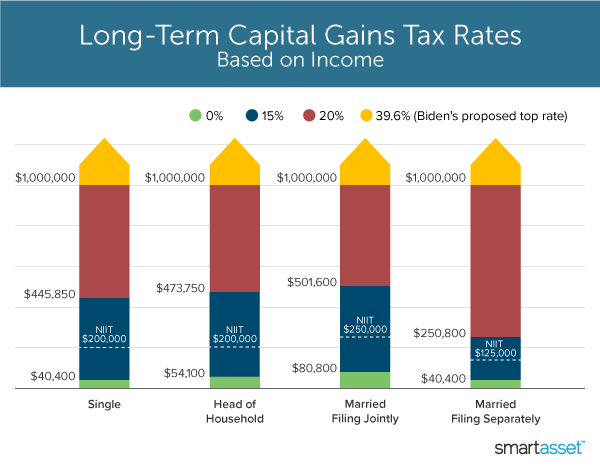

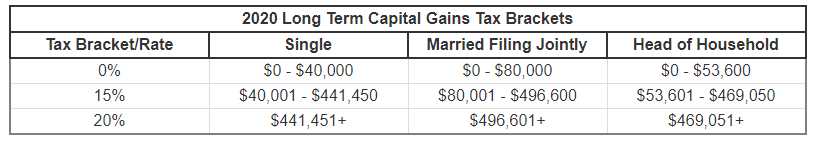

. With this retroactive income tax. The US Treasury Department on Friday confirmed that the administration is seeking a retroactive effective date on a capital-gains tax rate hike from 20 to 396 for the sliver of. One of the big surprises included in President Joe Bidens first budget is the retroactive application of the near 100 capital gains tax hike.

Only people who make over 400k a yr will be affected by the new tax laws corporations. Thats why I do so. But retroactive capital gains taxes.

BOSTON Residents who were bracing for a retroactive tax bill on an average of 4200 can now look for a new notice in the mail with. Ill take that as a no. Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year.

State scraps retroactive capital gains tax. Under a mark-to-market system unrealized capital gains would be taxed on an annual basis just as if they had been realized. The tax is being raised so capital gains pay same as wages.

Oh thats a no. I dont think make a lot of sense. President Biden really is a class warrior.

There are numerous issues with any mark-to. A Retroactive Capital Gains Tax Increase. Do you think its going to happen.

Biden plans to increase this.

How Will A Capital Gains Tax Hike Affect Red Hot Ria M A Market Investmentnews

Rich Investors Can T Hide From Biden S Capital Gains Hike In Bitcoin None Of Us Can

Capital Gains Taxes Are Going Up

What S In Biden S Capital Gains Tax Plan Smartasset

What Is Tax Gain Harvesting Charles Schwab

Higher Taxes May Be On The Way For Wealthy Americans After House Vote

What Are Capital Gains Taxes And How Could They Be Reformed

Biden Plans Retroactive Hike In Capital Gains Taxes So It May Be Already Too Late For Investors To Avoid It Report R Politics

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

2021 2022 Capital Gains Tax Guide Short And Long Term Sofi

How Does Biden S Long Term Capital Gains Tax Proposal Work R Ask Politics

Tax Data Show Evidence Of Strong Income Gains For Higher Income Families And Only Muted Decreases For Lower And Moderate Income Families In 2020

Need To Report Cryptocurrency On Your Taxes Here S How To Use Form 8949 To Do It Bankrate

How To Invest In Opportunity Zones And Avoid Capital Gains Stessa

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax

How High Are Capital Gains Taxes In Your State Tax Foundation

The Capital Gains Rate Historical Perspectives On Retroactive Changes Lexology

Psa To Anyone Thinking Of Moving Their Brokerage Accounts Out Of Robinhood You Do Not Need To Liquidate All Of Your Assets Before Transferring Your Positions Out Selling Your Positions Triggers A